10 Easy Facts About Apply For Medicare Described

Wiki Article

Medicare Select Plans for Dummies

Table of ContentsAll about Boomer Benefits ReviewsGetting My Medicare Select Plans To WorkExcitement About Medicare Supplement Plans Comparison Chart 2021 PdfExcitement About Shingles Vaccine Cost

Qualified Medicare Recipient (QMB) is a Medicaid program for individuals who are currently getting Medicare benefits. The objective of the program is to lower the expense of medications and also copays for physicians, hospitals, and clinical procedures. The QMB program may vary by state. For the objective of this write-up, we are going over the QMB program as it associates to Florida.

As with all Medicaid programs, QMB has earnings and also possession restrictions that must be met in order for someone to qualify for this program. Benefits of the QMB program include: Medicare Part A & B costs paid back in your Social Safety And Security Check Medicare Part D costs lowered or covered via the Reduced Revenue Aid (LIS)/ Extra Help program Medication costs decreased to $0 $10 for the majority of drugs via the LIS/ Additional Help program No Donut Hole/ Coverage Gap Medicare deductibles paid by Medicaid Medicare coinsurance and also copays within suggested restrictions paid Right here is an example of how the QMB program can help someone: When in the Donut Opening, Insulin can set you back $300 per month.

Our Medicare Part C Eligibility Ideas

You can additionally reveal a duplicate of your Medicare Recap Notice. If you're charged, encourage the provider that you're enlisted in the QMB program - medicare part c eligibility.

It is essential to recognize, nonetheless, that certain amounts of earnings are not counted in determining QMB eligibility - medicare oep. Especially if you are still working and a lot of your revenue originates from your revenues, you may have the ability to certify as a QMB also if your complete income is nearly twice the FPG.

If, after using these rules, the figure you reach is anywhere near to the QMB certifying restriction (in 2020, $1,083 in month-to-month countable earnings for a specific, $1,457 for a couple), it is worth looking for it. (The limits are rather greater in Alaska as well as Hawaii.) Asset Limits There is a limit on the worth of the properties you can have as well as still certify as a QMB (medicare select plans).

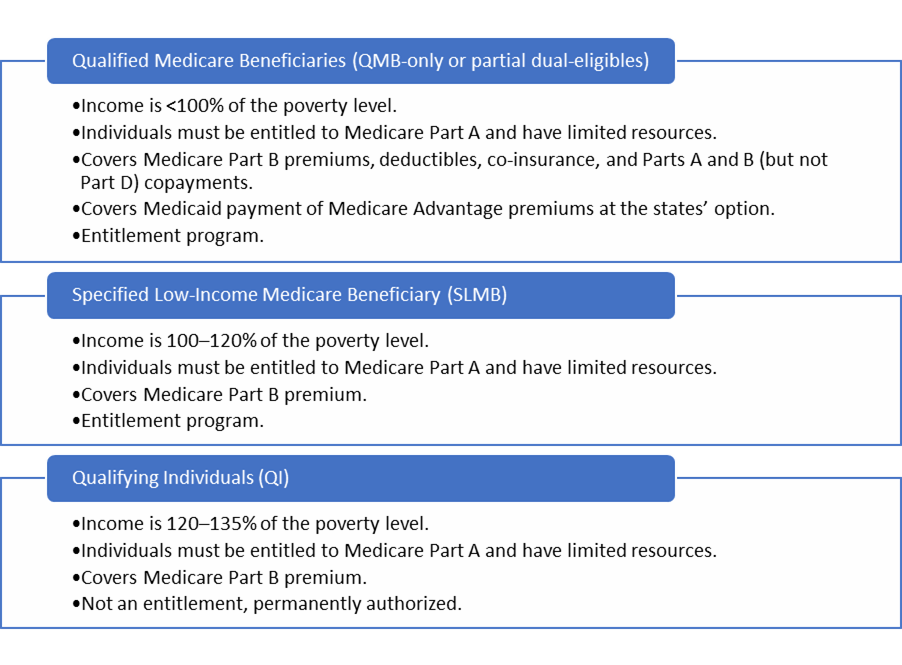

Because the SLMB as well as QI programs are for people with greater incomes, they have less advantages see this page than the QMB program. The SLMB and QI programs pay all or component of the Medicare Part B regular monthly costs, yet do not pay any Medicare deductibles or coinsurance quantities. This indicates possible financial savings of even more than a thousand bucks per year.

Unknown Facts About Medicare Supplement Plans Comparison Chart 2021 Pdf

If you are located disqualified for one program, you might still be discovered eligible for one of the others. Where to File To get the QMB, SLMB, or QI programs, you have to file a written application with the firm that handles Medicaid in your stateusually your area's Department of Social Solutions or Social Welfare Division.Although a Medicaid eligibility employee may require additional particular information from you, you will at the very least have the ability to get the application procedure started if you bring: pay stubs, earnings tax returns, Social Safety and security advantages info, and also other evidence of your existing earnings papers showing all your financial savings as well as various other monetary properties, such as bankbooks, insurance plan, as well as stock certifications automobile registration documents if you possess a vehicle your Social Safety card or number info about your spouse's revenue and also separate possessions, if both of you live together, as well as clinical costs from the previous three months, along with clinical records or reports to verify any kind of medical problem that will require therapy in the future.

Inquire about the treatment in your state for getting a hearing to appeal that choice. At a charm hearing, you will certainly have the ability to offer any documents or other papersproof of earnings, properties, medical billsthat you think sustain your claim. You will likewise be enabled to clarify why the Medicaid choice was incorrect.

You are allowed to have a friend, loved one, social employee, attorney, or various other depictive appear with you to aid at the hearing. Although the exact treatment for getting this hearing, and also the hearing itself, might be somewhat various from state to state, they all appear like extremely carefully the hearings provided to candidates for Social Protection benefits.

The Only Guide to Shingles Vaccine Cost

Getting Aid With Your Charm If you are denied QMB, SLMB, or QI, you may wish to seek advice from somebody experienced in the based on aid you prepare your allure. One area you can locate high quality cost-free assistance with these matters is the nearest office of the State Medical Insurance Support Program (SHIP).Report this wiki page